Low-cost carriers (LCCs) are soaring high in terms of their revenue-generating strategies. While known for their budget-friendly fares, LCCs have also mastered the art of upselling and cross-selling through a diverse range of ancillary services. This presents a unique opportunity for travel insurers, who can tap into this growing market and tailor their offerings to specific, value-conscious travelers.

This article, drawing insights from our “Top 50 Airlines Travel Insurance Benchmark 2024” study, explores how LCCs are strategically utilizing ancillary offerings and forming travel insurance partnerships, creating a lucrative market for forward-thinking travel insurers.

LCCs have transformed the travel landscape by offering an expansive array of ancillary services. This shift creates a dynamic ecosystem that caters to diverse traveler needs and preferences.

The key to this approach is giving people control. LCCs break down traditional flight fares, offering core services like checked baggage and seat selection separately. This means travelers can build their own personalized trips, paying only for what they actually want. This flexible way of doing things is perfect for today’s budget-conscious travelers who value having choices and making their own decisions about their travels.

But that’s not all! LCCs also use these services to create a smooth and convenient travel experience. By teaming up with other companies, they offer things like booking hotels, renting cars, and even getting travel insurance all in one place. This one-stop-shop approach makes things easier for travelers and helps LCCs sell even more by suggesting related services.

Among the top 50 airlines in our study, six LCCs stand out for their robust ancillary service portfolios: Southwest, Ryanair, easyJet, AirAsia, Jetstar, and Pegasus (Flypgs). These airlines prioritize customer value and convenience, offering a wide array of ancillary services tailored to modern travelers’ needs.

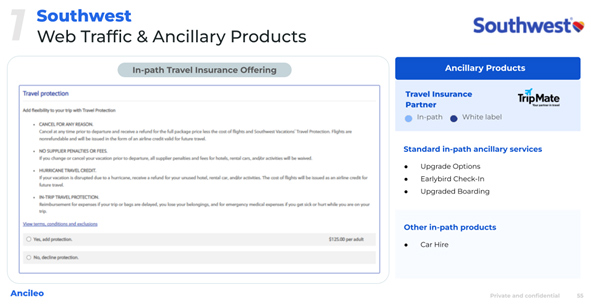

Southwest Airlines goes above and beyond with its array of ancillary services, designed to elevate the travel experience. From upgrade options to early bird check-in and upgraded boarding, Southwest caters to the preferences of diverse travelers. Additionally, Southwest offers car hire services to ensure seamless transportation arrangements for its passengers.

In partnership with TripMate, Southwest provides a white-label travel insurance offering that encompasses Cancel For Any Reason (CFAR), Hurricane Travel Credit, and In-trip Travel Protection. This strategic collaboration addresses the evolving needs of budget-conscious flyers, aligning with key travel trends and offering peace of mind during uncertain times.

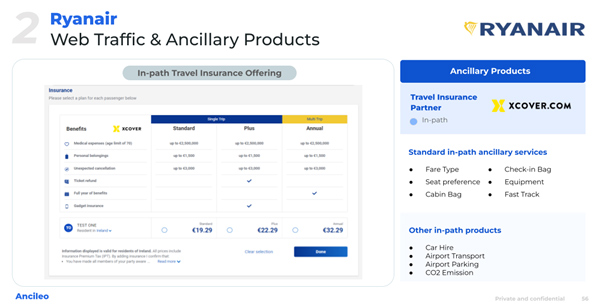

Ryanair, a European powerhouse, distinguishes itself with its comprehensive range of add-ons tailored to diverse traveler needs. From fare types to seat preferences, cabin bags, and fast-track options, Ryanair personalizes the travel experience while maximizing revenue streams.

Their Cover Genius-powered insurance caters to the value-driven segment, addressing medical expenses, unexpected cancellations, and even gadget protection, ensuring peace of mind without breaking the bank.

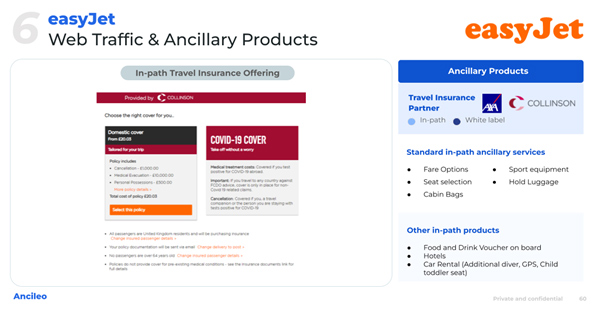

Beyond standard offerings, easyJet goes the extra mile with food and drink vouchers for onboard refreshments, convenient hotel bookings for seamless connections, and car rentals with add-ons like child seats for families. This creates a one-stop shop for a convenient travel experience, especially valuable for families and leisure travelers.

easyJet also offers a white-label travel insurance solution in partnership with Collinson. This solution provides domestic cover, including cancellation, medical evaluation, and personal possessions protection. Additionally, easyJet addresses current travel concerns by offering COVID-19 coverage, encompassing medical treatment costs and trip cancellation expenses.

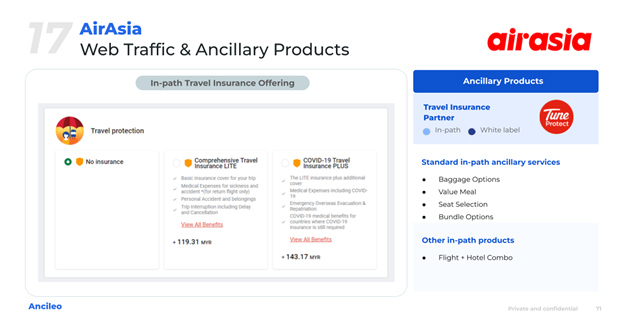

AirAsia’s bundled packages set it apart, allowing passengers to combine flights with hotels, meals, and baggage allowances for a convenient and cost-effective travel experience. This approach resonates with the growing trend of experience-driven travel, where exploration takes precedence over luxury.

Their Tune Protect insurance complements their ancillary services, covering medical expenses, personal accidents, belongings, and trip interruptions, including COVID-19 coverage. This comprehensive protection ensures a secure and protected journey for budget-conscious adventurers, aligning with evolving travel preferences.

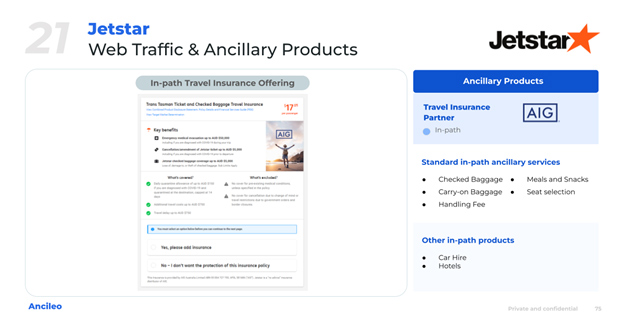

Jetstar caters to price-conscious travelers by prioritizing essential ancillary services such as checked baggage, meals, and seat selection. This focus ensures a comfortable flight experience without unnecessary frills, appealing to budget-conscious flyers.

In collaboration with AIG, Jetstar offers an in-path travel insurance solution addressing COVID-19 coverage, travel delays, and checked baggage protection. This partnership meets the needs of tech-savvy travelers who seek targeted insurance solutions addressing specific concerns at an affordable price.

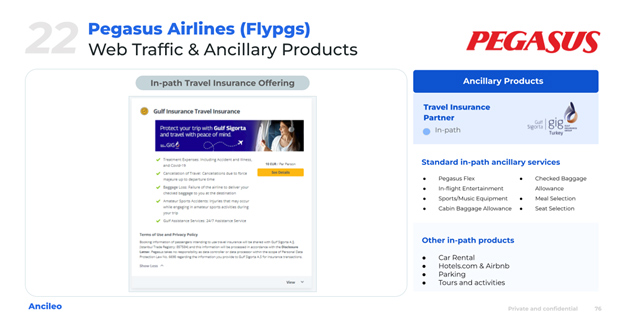

Pegasus Airlines offers a diverse range of ancillary services, including in-flight entertainment, sports equipment carriage, and pre-booked meals, enhancing the overall travel experience. These offerings cater to a wide range of traveler needs and preferences, ensuring a seamless journey from start to finish.

Partnering with Gulf Insurance Group (GIG), Pegasus provides an in-path travel insurance solution covering travel cancellation, medical expenses, baggage loss, amateur sports accidents, and 24/7 Gulf Assistance services. This comprehensive coverage caters to various risk profiles, offering peace of mind to travelers throughout their journey.

LCCs and travel insurers represent a powerful partnership waiting to be fully realized. On one hand, LCCs boast a rapidly growing customer base hungry for value-added services. On the other, travel insurers seek to expand their reach and cater to budget-conscious travelers. This opportunity creates a fertile ground for mutually beneficial partnerships, unlocking significant growth potential for both parties.

For LCCs:

For Travel Insurers:

As the LCC market continues to mature and evolve. We can expect even more innovative and strategic partnerships with travel insurers. These collaborations will likely move beyond basic coverage, offering customized insurance solutions integrated seamlessly into the overall travel booking experience.

By recognizing the shared benefits and actively fostering these partnerships. LCCs and travel insurers can unlock significant growth opportunities. Ultimately creating a more secure and enjoyable experience for the value-conscious traveler.